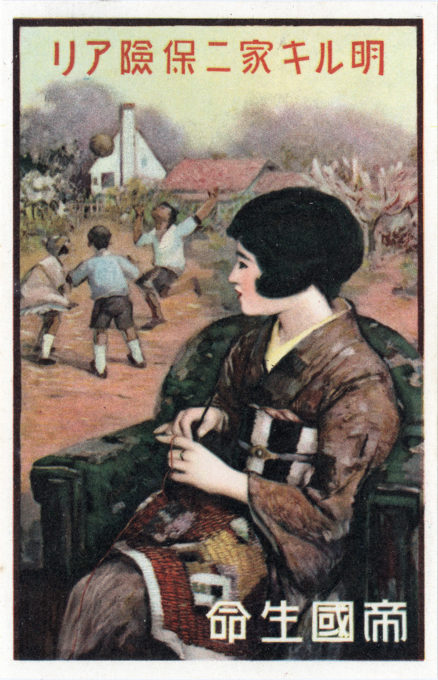

“My family has two coats of armor”, Imperial Life Insurance Co. advertising postcard, c. 1930. The Imperial Life Insurance Company (Teikoku Seimei Hoken Kaisha), founded in 1888 in Tokyo, was one of Japan’s two earliest life insurance companies (Meiji Life, the earliest, was founded in 1881) and typified the early, extraordinary “wild west” nature of Japan’s rapid 19th century modernization. One of the company’s co-founders was a former Chief pharmacist of the (Imperial Japanese) Naval Hospital, Fukuhara Arinobu. Disbanded, reorganized and renamed in the aftermath the Pacific War, Imperial Life lives on today as the Asahi Mutual Life Insurance Company.

See also:

Jinju Seimei Hoken K.K. (Jinju Life Insurance Co.), Tokyo, c. 1920.

Meiji Mutual Life Insurance Co. Building, Marunouchi, c. 1946.

“Although modern life insurance originated in Western countries and foreign insurance companies had entered Japan at designated ports for foreign trade already before the beginning of the Meiji period, such as Yokohama and Nagasaki, they hardly contributed to the development of Japan’s domestic life insurance industry. Most of them focused on selling non-life insurance and targeted foreign residents.

“Before the Insurance Business Act took effect [in 1900], the Japanese government passed the Imperial Ordinance regarding Foreign Insurance Companies. It stipulated that foreign companies had to apply for a license by the end of 1899 if they wanted to continue their business. By 1911, only seven foreign companies, all from the UK and the US, had received life insurance licenses. Their combined volume of policies in force amounted to 65.5 million yen in 1912, about eight percent of the volume of policies managed by domestic companies.

“The first domestic life insurance company, Meiji Seimei Hoken, in Japan was founded in 1881. For seven years, Meiji Life was the only company in the industry. In 1888, Teikoku Seimei Hoken [Imperial Life Insurance] entered the market, followed by Nippon Life and Dai Nippon Life in 1889. The 1890s saw a boom in new business establishments with a peak of 37 active companies in 1899 and 1900. [But this growth] ended abruptly in 1900, when the economy fell into a recession. The number of life insurance companies consequently dropped to 26 in 1905.

“By the end of 1912, there were 33 companies offering life insurance products [and] the industry had been put on a solid institutional foundation and had achieved a healthy level of business activity, and obtained a sound legal basis. The first industry newspaper was launched in October 1898. In 1899, the Japan Actuary Society was founded.

“Within the government, industry and academia work on actuarial life tables was undertaken to improve the adequacy of life insurance premiums. Ties between industry leaders and academia helped to not only improve actuarial skills, but also promoted the establishment of chairs and courses for insurance at Japanese institutions of higher education.”

– “Entrepreneurship in a Transition Economy: Life Insurance in Meiji Japan”, by YingYing Jiang, Journal of Global Management, Vol. 1, March 2022

Pingback: Fukuju Life Insurance Co. New Year’s advertising postcard, Nagoya, 1930. | Old TokyoOld Tokyo