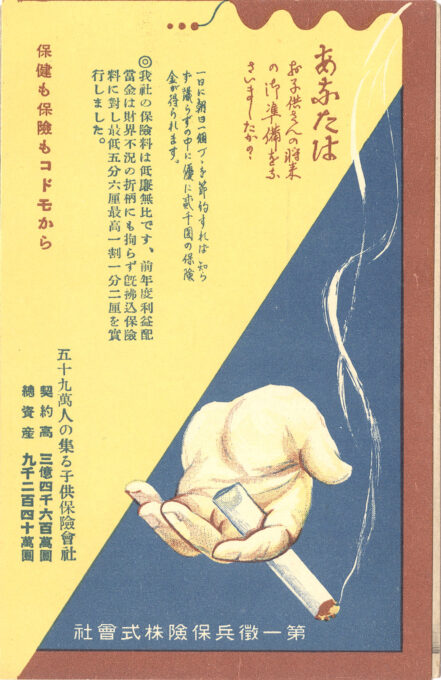

Daiichi Conscription Insurance Co., Ltd. advertising postcard, Osaka, c. 1930. In the late 19th century, two merchants from Shiga Prefecture, one of whom was also in charge of the local conscription office, became highly concerned about the hardship military service inflicted on the poorer population. In 1896, their application for a stock company named Chōhei Hoken, which literally means ‘conscription insurance’, was approved by the Ministry of Agriculture and Commerce, and became the first major company in the field. One caption on the postcards reads: “Our premiums are low and inexpensive. In spite of the recession, we paid a low 5.6% and a high 11.2% on premiums paid in the previous year.”

See also:

“My family has two coats of armor”, Imperial Life Insurance Co. advertising postcard, c. 1930.

Propaganda postcard reproduction of a 35th Army Day poster, March 10, 1940.

“Japan’s Conscription Law of 1873 constituted a core element of the military reforms implemented by the Meiji government. The law implied an additional burden in the form of a ‘tax in kind’ which would not be shared equally, because only a small portion of those eligible to serve were actually recruited.

“As the government neither alleviated the hardship nor corrected the inequalities created by the conscription system, local communities and private entrepreneurs took initiative. One response was conscription insurance.

“… Conscription insurance constituted a separate branch within the insurance industry. It differed from non-life insurance, because it did not insure against the loss or damage of property. It was, however, also not a typical life insurance product, as it did not insure against the death of a family member … Instead, conscription insurance offered coverage against the ‘risk’ of getting drafted. This risk was related to the income lost during the time of regular service.

“In an economy like Japan’s, which was just about to embark on the process of industrialization, the income loss would often be incurred by a family or household, which would not be able to employ their son’s labor, for example in agriculture, fisheries or other family business.

“… Typically, parents would buy the insurance when their son was still at a young age and then regularly pay the insurance premiums up to his 20th birthday. Should the lottery decide that he gets drafted, the family would receive the contractually agreed upon insurance payment. Otherwise, it would only obtain the paid-in premiums. It was possible to buy conscription insurance up until the son reached the age of 15. Of course, a shorter pay-in period implied higher annual premiums or lower coverage or both.

“If a son died before his 20th birthday, the family would receive the paid-in premiums up until his death. Insurance contracts also accounted for the possibility that someone would not complete the full three years of service or would volunteer to serve. In both cases, only 80% of the coverage would be paid out.

“… The history of Japan’s conscription insurance industry ended with the country’s defeat in the Pacific War, which brought an end to military conscription.”

– Conscription Insurance in Pre-war Japan – Private Enterprise and National Interest, by YingYing Jiang, Taylor & Francis Online, October 15, 2022